Forex Brokers: Professional Evaluations and Referrals

Forex Brokers: Professional Evaluations and Referrals

Blog Article

Decoding the World of Foreign Exchange Trading: Uncovering the Value of Brokers in Making Sure and managing risks Success

In the intricate realm of foreign exchange trading, the duty of brokers stands as a critical component that typically remains shrouded in enigma to many hopeful investors. The importance of brokers goes past plain transaction facilitation; it reaches the realm of threat management and the general success of trading undertakings. By delegating brokers with the job of browsing the complexities of the forex market, traders can potentially unlock a world of chances that could otherwise continue to be evasive. The detailed dancing in between investors and brokers introduces a cooperative partnership that holds the key to untangling the enigmas of profitable trading ventures.

The Role of Brokers in Forex Trading

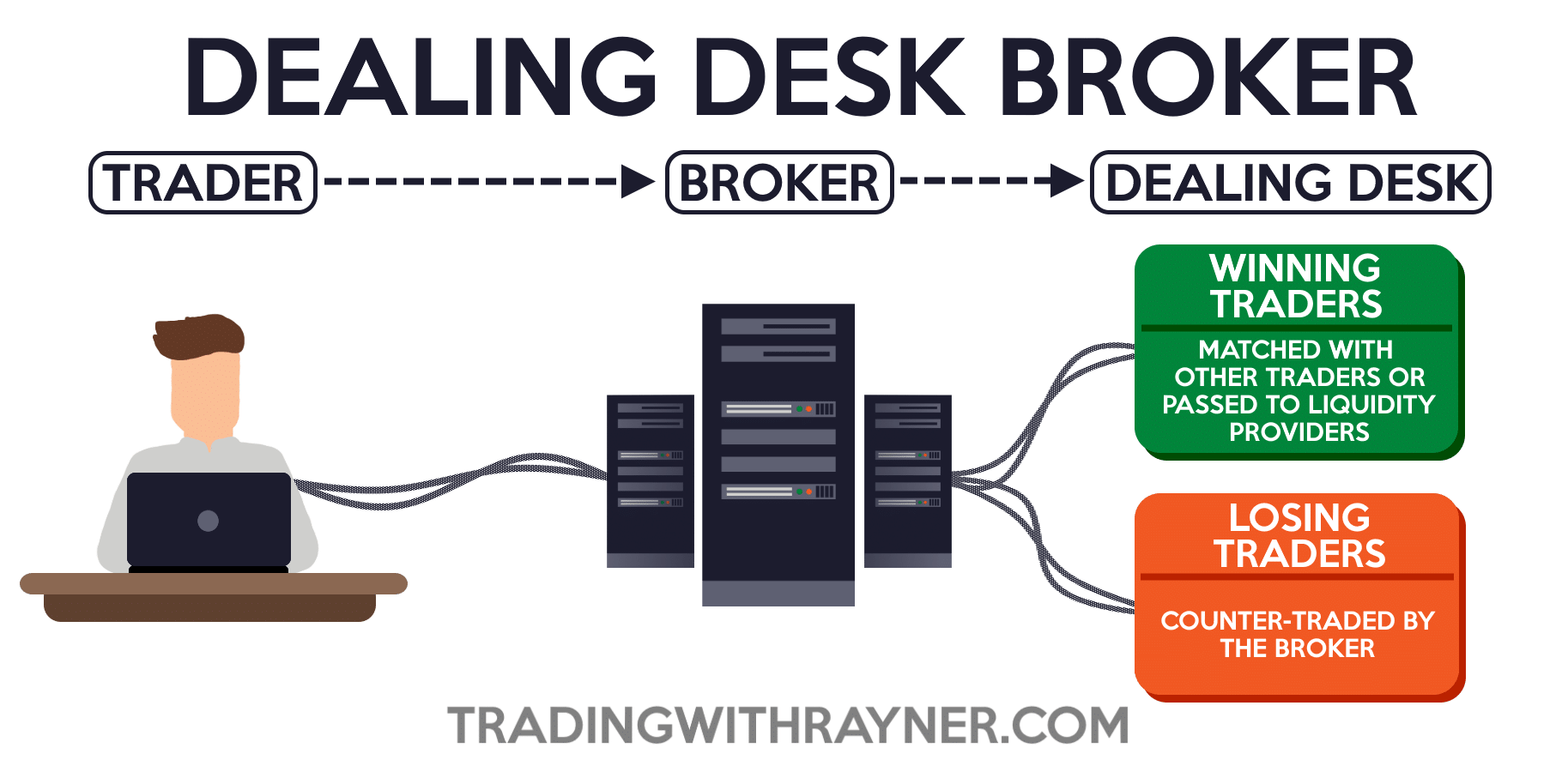

Brokers play a vital function in forex trading by providing important solutions that assist traders manage risks efficiently. These economic middlemans serve as a bridge between the investors and the forex market, using a variety of services that are vital for browsing the intricacies of the forex market. Among the main functions of brokers is to supply traders with accessibility to the market by assisting in the implementation of trades. They offer trading systems that enable investors to market and buy currency sets, offering real-time market quotes and making sure swift order implementation.

In addition, brokers use leverage, which makes it possible for traders to control bigger placements with a smaller amount of funding. While utilize can enhance earnings, it also enhances the potential for losses, making risk monitoring vital in foreign exchange trading. Brokers give threat administration tools such as stop-loss orders and limit orders, enabling investors to establish predefined exit points to minimize losses and secure profits. Furthermore, brokers supply academic resources and market evaluation to aid investors make notified decisions and develop reliable trading methods. Overall, brokers are indispensable partners for traders looking to browse the foreign exchange market effectively and handle dangers successfully.

Danger Monitoring Methods With Brokers

Provided the essential function brokers play in facilitating accessibility to the foreign exchange market and giving danger monitoring devices, understanding effective strategies for handling threats with brokers is necessary for successful forex trading. One vital strategy is establishing stop-loss orders, which enable traders to determine the optimum amount they are willing to lose on a profession. This tool assists limit prospective losses and shields versus adverse market activities. Another crucial threat management method is diversity. By spreading investments across different money sets and possession classes, traders can lower their direct exposure to any kind of single market or instrument. Additionally, making use of utilize meticulously is essential for risk monitoring. While utilize intensifies earnings, it likewise amplifies losses, so it is important to use take advantage of carefully and have a clear understanding of its ramifications. Finally, preserving a trading journal to track efficiency, examine past trades, and identify patterns can help traders fine-tune their approaches and make even more informed choices, inevitably improving threat monitoring methods in forex trading.

Broker Choice for Trading Success

Choosing the best broker is critical for attaining success in foreign exchange trading, as it can substantially impact the overall trading experience and end results. Working with a regulated broker gives a layer of protection for traders, as it ensures that the broker runs within set guidelines and criteria, therefore minimizing the danger of fraud or malpractice.

Additionally, investors need to evaluate the broker's trading system and tools. Taking a look at the broker's consumer support services is vital.

In addition, traders should review the broker's cost structure, including spreads, commissions, and any kind Check This Out of hidden fees, to understand the price ramifications of trading with a specific broker - forex brokers. By meticulously examining these aspects, investors can select a broker that straightens with their trading goals and sets the stage for trading success

Leveraging Broker Proficiency commercial

Just how can traders effectively harness the proficiency of their picked brokers to make best use of earnings in foreign exchange trading? Leveraging broker competence for profit needs a strategic method that entails understanding and using the solutions offered by the broker to improve trading end results.

Developing an excellent relationship with a broker can lead to individualized guidance, profession referrals, and danger management strategies customized to individual trading designs and goals. By connecting frequently with their brokers and looking for input on trading approaches, investors can touch into skilled expertise and boost their total performance in the forex market.

Broker Aid in Market Analysis

Broker aid in market evaluation prolongs beyond just technological evaluation; it likewise includes essential analysis, belief evaluation, and threat monitoring. By leveraging their experience and accessibility to a vast array of market data and research tools, brokers can help investors browse the complexities of the forex market and make well-informed choices. Additionally, brokers can provide timely updates on economic events, geopolitical developments, and various other aspects that may impact currency rates, allowing investors to remain ahead of market fluctuations and readjust their trading settings as necessary. Ultimately, by utilizing broker assistance in market analysis, traders can improve their trading performance and boost their opportunities of success in the competitive foreign exchange market.

Conclusion

To conclude, brokers play a crucial duty in foreign exchange trading by managing threats, supplying competence, and assisting in market evaluation. Selecting the right broker is crucial for trading success and leveraging their understanding can bring about revenue. forex brokers. By address making use of danger monitoring techniques and functioning closely with brokers, traders can browse the complex globe of foreign exchange trading with confidence and raise their chances of success

Provided the crucial function brokers play in facilitating access to the international exchange market and providing danger monitoring devices, understanding efficient approaches for managing risks with brokers is necessary for successful forex trading.Choosing the appropriate broker is critical for attaining success in forex trading, as it can dramatically affect the overall trading experience and results. Functioning with a managed broker provides a layer of safety for investors, as it makes certain that the broker operates within set standards and criteria, thus decreasing the danger of scams or negligence.

Leveraging broker proficiency for revenue needs a critical approach that involves understanding and go to the website using the services offered by the broker to enhance trading end results.To efficiently utilize on broker experience for profit in forex trading, investors can count on broker assistance in market analysis for notified decision-making and threat mitigation methods.

Report this page